If you’ve been wondering if your marketing is really working, start by measuring what you’re doing now – and make better choices for your next marketing campaign.

Cleaning business owners invest in their companies in many different ways; from equipment to training, we make decisions on how to spend limited capital to create the most value. Value can be thought of as a function of what we gain from an investment relative to what we put into it. The financial term for this is Return on Investment, or ROI. If the ROI is positive, the investment is making us money; if it is negative, it is not.

All things being equal, we should pursue investments with the largest ROIs, right? So let’s put this theory to the test. The formula looks like this:

Return on Investment = (gain from investment – cost of investment) / cost of investment

For most business investments, we can use this approach to estimate relative value between investment alternatives, and make purchasing decisions with confidence. But when we apply the same logic to our marketing budget, the anticipated return is more difficult to predict, and the purchasing decisions are often made with more hope than confidence.

As with all business processes, you can’t manage what you can’t measure. Marketing is no exception. To measure the benefits of a marketing campaign, you should consider a broader set of metrics than most other processes, including both hard and soft benefits. With the right metrics in place, you can determine which marketing campaigns are delivering the best return and make future marketing decisions with more confidence.

It is best to start any evaluation of marketing alternatives with an ROI calculation. There are multiple methods to calculating marketing ROI. Some are more appropriate than others, and depend largely on whether you are selling reoccurring client accounts or if you are going primarily after one-time jobs.

Lifetime Value ROI for Businesses Focusing on Reoccurring Clients

The Lifetime Value Method of calculating marketing ROI is useful in evaluating marketing campaigns targeting reoccurring clients. This approach uses the lifetime gross profit from clients gained as the benefit gained from the investment.

A good approximation of this number can be calculated by multiplying the gross lifetime revenue from a client by the Payroll % to Revenue.

Example: a cleaning company invests $6,000 in a direct marketing campaign, resulting in 5 reoccurring clients. With an average lifetime revenue/client of $5,000 and a 45% payroll % to revenue, the ROI would be 129%, as shown below.

Check out Cleaning Business Today’s KPI videos for instructions on calculating

C: Average Lifetime Revenue per Client

D: Payroll % to Revenue

Cost of Goods Sold ROI for Businesses Focusing on Project Work and One-Time Jobs

Another technique for calculating marketing ROI that works well for campaigns focusing on project work and one time jobs is the Cost of Goods Sold (COGs) Method. This approach to calculating the ROI takes the average revenue/job generated from a marketing campaign and subtracts the average total direct payroll/job to get an approximation for gross profit/job.

Example: A cleaning company invests in printing for a flyer promoting refrigerator cleaning as this month’s promotion; the intention is for the cleaning techs/teams to leave one behind in each home they visit each day. The printing cost was $250, and 20 refrigerator cleans were sold at $40 each; the loaded payroll cost is $6 per refrigerator. The ROI would be 172%, as shown below:

It is good to evaluate every marketing campaign using the appropriate ROI method, with the idea of investing most heavily in the campaigns with the highest ROI. Both of our examples resulted in a positive ROI. When a marketing campaign shows a positive ROI, a company can continue to invest in it with confidence, knowing that it is contributing to the profitability of the business.

Weighing Soft Benefits Against a Negative ROI

Sometimes when a company measures the results of a marketing campaign the numbers don’t look as good. If a campaign’s cost exceeds its measured gross profit, the ROI will be negative, implying that the campaign is a bad investment. Before dismissing the opportunity, be sure to examine the soft benefits from a well-designed campaign that may be realized even when direct sales aren’t as good.

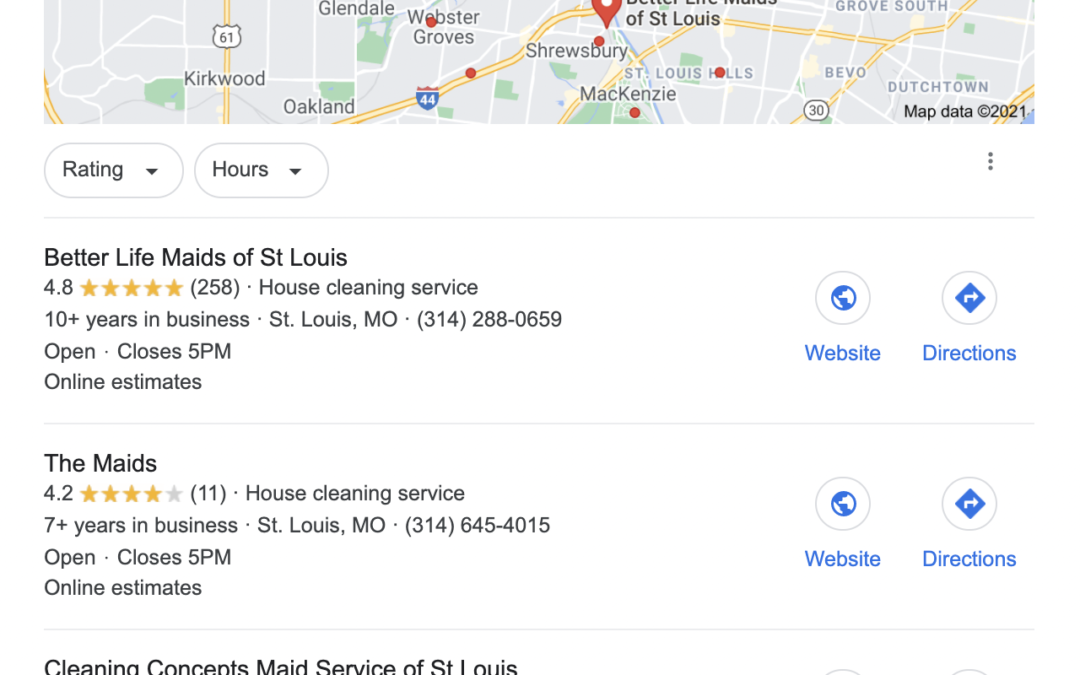

In the digital marketing world, the increase in Eyeballs (views), Engagement (likes, clicks and comments), and Perception (reviews, shares and peer endorsements) may be of more value than direct sales as the primary objective or secondary soft benefit of a campaign. Driving traffic to your website, getting likes and shares in social media, and driving online review traffic might not be attributable to direct sales but can contribute in a big way to overall growth. And since all major social networks and website analytics offer free reporting on business pages, it’s a simple matter to review the data to add to your analysis of marketing campaign ROI.

When evaluating the performance of a marketing campaign it is important to consider both the hard and soft benefits. When the ROI is positive you can be confident that the campaign is making money and any soft benefits are just extra value. But when a campaign’s ROI is negative, consider how else it might be contributing to your company. Increasing traffic to your website, getting more Facebook likes, or more five-star reviews on Yelp can add real value to your business even if they are not producing immediate and direct revenue. Measuring both the hard and soft benefits of your marketing campaigns will help you decide how to spend marketing dollars to produce the desired results.

Tom Stewart and his wife, Janice Stewart, are co-owners of Castle-Keepers, the 1st company to achieve CIMS certification. Tom is a nationally-recognized leader & innovator in the house cleaning industry. He is co-founder and Publisher of Cleaning Business Today.